Modest family home or sprawling estate? Three bedrooms or eight? Studio in the center of town or cozy 2-bedroom with a countryside view? The biggest question of all: How much house can I afford?

Before you start the homebuying process, it’s important to first establish a budget.

Once you know exactly how much house you can afford, you can find a home that fits both your budget and your lifestyle.

Here’s how.

Calculate how much house you can afford.

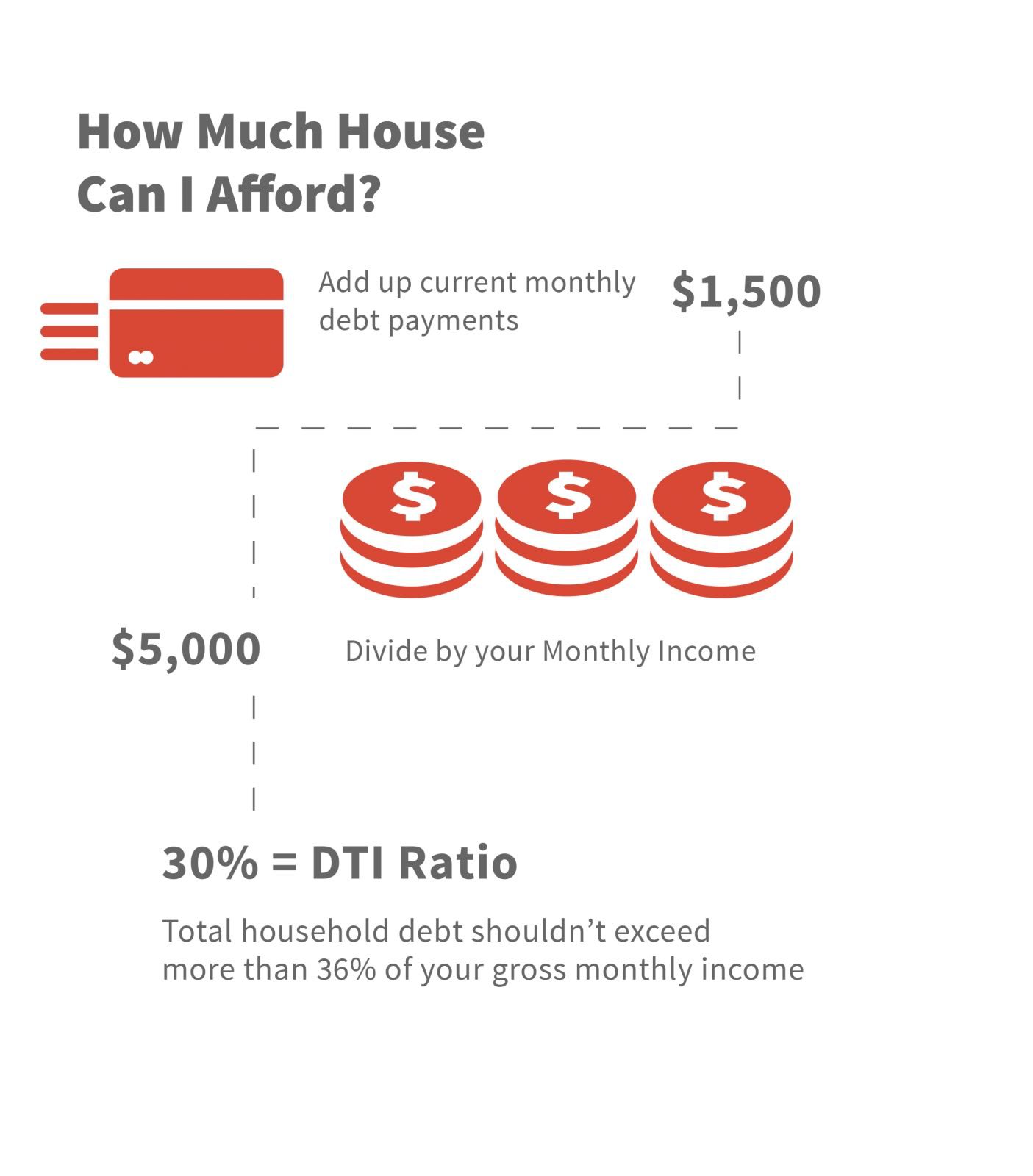

One common method for answering ‘how much house can I afford’ is the 36% rule, which factors in your debt-to-income (DTI) ratio. This rule of thumb states that your monthly debt – including your estimated mortgage payment, credit cards, student loans, car payment, etc. – shouldn’t exceed 36% of your gross monthly income. For example, if your gross monthly income is $5,000, your monthly debt payments should not exceed $1,800 ($5,000 X 36% = $1,800).

However, this is just a guideline. Some lenders may approve a DTI ratio as high as 42%, or as low as 28%, depending on your current levels of debt.

To calculate your DTI ratio, simply add up all of your current monthly debt payments and divide it by your gross monthly income. For example, if your monthly debt payments total $600 and your monthly income is $5,000, then your DTI ratio is $600/$5,000, or 12%.

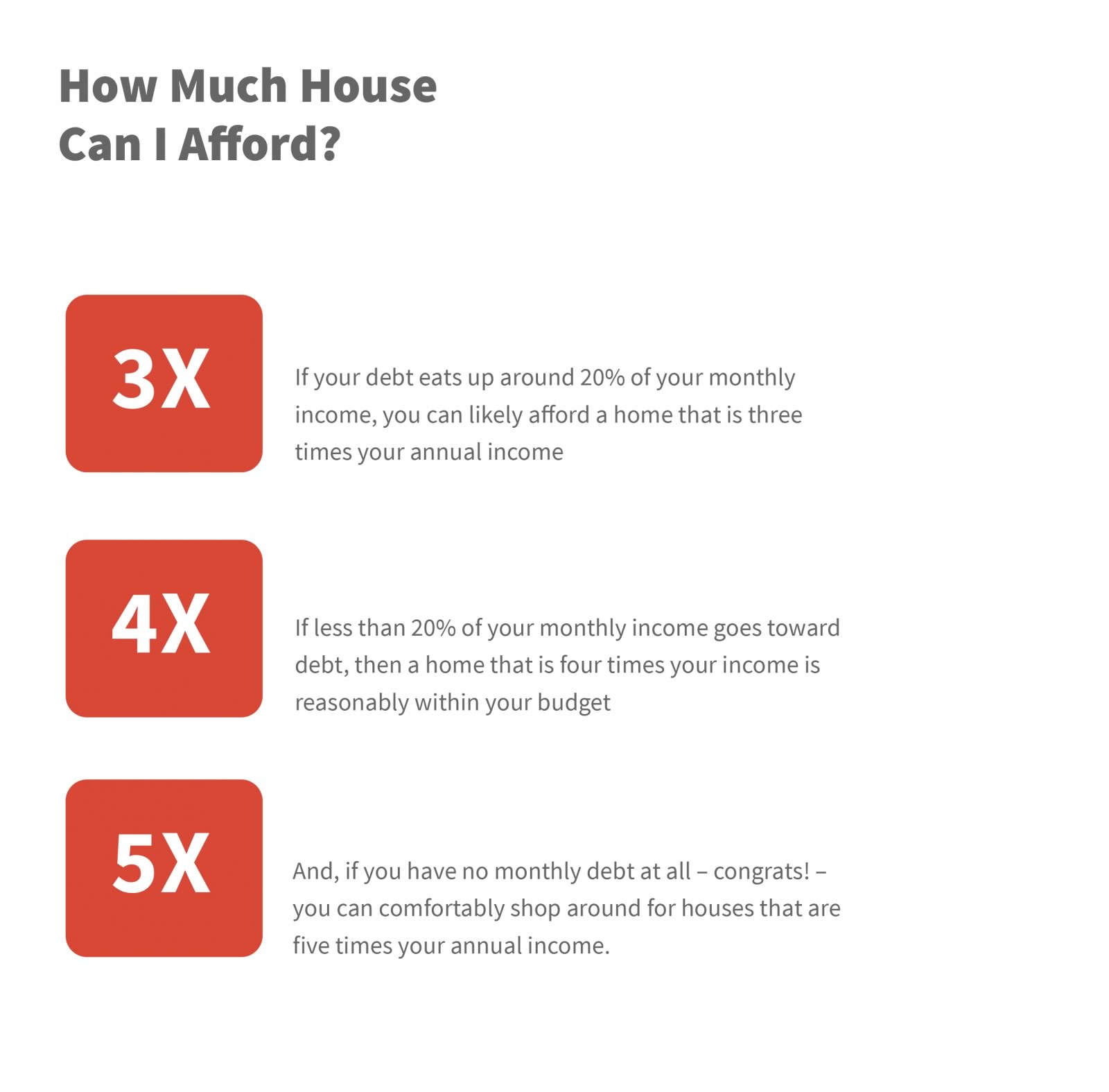

A simpler, back-of-envelope calculation for how much house you can afford is three to five times your total annual household income.

Save for a down payment & closing costs.

Ideally, you want to have 20% of a home’s value saved for a down payment. This will qualify you for a conventional loan and help you avoid having to pay private mortgage insurance (PMI), which is an additional monthly charge.

If you don’t have a 20% down payment saved, don’t worry. You may still be able to find other loan options. For example, FHA (Federal Housing Administration) and VA (Veterans Affairs) loans often require little to no down payment. Keep in mind that without the 20% down payment, you will have the cost of PMI added to your monthly payment with these types of loans.

Further, you will be responsible for closing costs, which can total several thousand dollars.

Check your credit.

Your credit score and credit history will impact each lender’s decision as to how much you can borrow and at what interest rate. Therefore, it’s important you check your credit score and report. If you find any errors, work to fix them immediately. You don’t want to be taken by surprise if you are not approved for the loan amount you need because of your credit profile. To better understand how credit score impacts your home loan, check out this blog: Understanding How Credit Score Impacts Your Home Loan.

Build a cash reserve.

Before approving a loan, lenders also want to know that purchasing a home won’t leave you broke. A substantial cash reserve will help prove that you can afford the house you want. Consider saving three to six months’ worth of expenses. This emergency fund will help you stay current on your bills if something unexpected occurs, such as the loss of a job or a medical emergency.

Work with a mortgage professional.

Ultimately, there are a lot of moving parts when it comes to finding out how much house you can afford. While there are plenty of home loan calculators online, nothing is as accurate as the customized guidance of working directly with a mortgage professional who can assess your entire financial picture and help determine a responsible home price for you and your family.