If you spot suspicious activity or realize that you’ve fallen victim to fraud, knowing what to do next is critical. Follow these three essential steps to secure your accounts, limit losses, and restore your peace of mind.

Security & Fraud Awareness Tips: Next Steps After Fraud

3 Essential Steps after Spotting Fraud

-

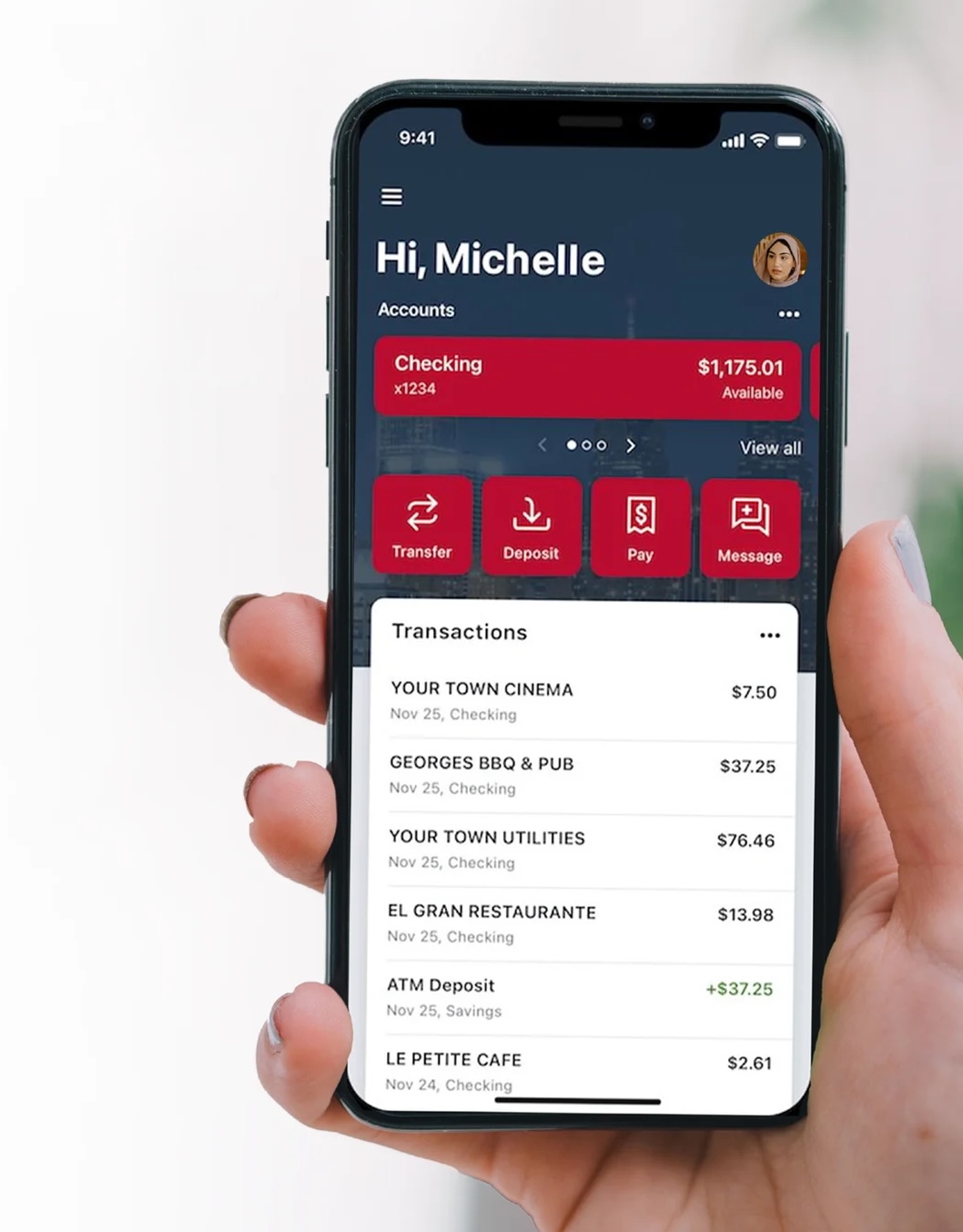

- If you experience debit card fraud, deactivate the card and compile a list of fraudulent transactions. The first step in responding to debit card fraud is to deactivate your card through Meridian’s Digital Banking. Login and navigate to the Card management section of your dashboard to toggle your card off. Once complete, compile information about the fraudulent transactions into a list including merchant name, date and amount.

- If you experience check fraud, review check images and compile a list of fraudulent check information. If you experience check fraud, you’ll want to examine your check images closely. Login to Meridian’s Digital Banking and select your account to review the account history. Select the check to further view the image for accuracy. Next, compile fraudulent transaction information including check number, dollar amount and payees.

- Contact Meridian’s fraud team. Email fraud@meridianbanker.com with the information you’ve compiled about the incident. We will review and respond to your message within one business day. If you submit a fraud case over the weekend, we will review it first thing the next business day.

For business banking customers, Meridian offers Positive Pay to prevent check or ACH fraud.

Upload a list of checks or ACH’s for matching to control unauthorized activity. If a payment presented doesn’t match what is on your list, you’ll decide if you want to pay or return it. If you’re interested in setting up Positive Pay for your business, fill out the form below to get started.

Not signed up for Digital Banking? Enroll today!

If you have a personal account, visit: meridianbanker.com/digital-banking

If you have a business account, please fill out the form below to get started.

Benefits Include:

- Electronic statements and notices

- Bill pay

- Account transfers

- Mobile deposit

- Card controls

- Account alerts

- Secure messaging