- All tenant improvements, FF&E, soft costs and working capital needs were included in loan budget

- 90% financing of total project costs

- Referred to Meridian by customer’s attorney who had successfully worked with our SBA team previously

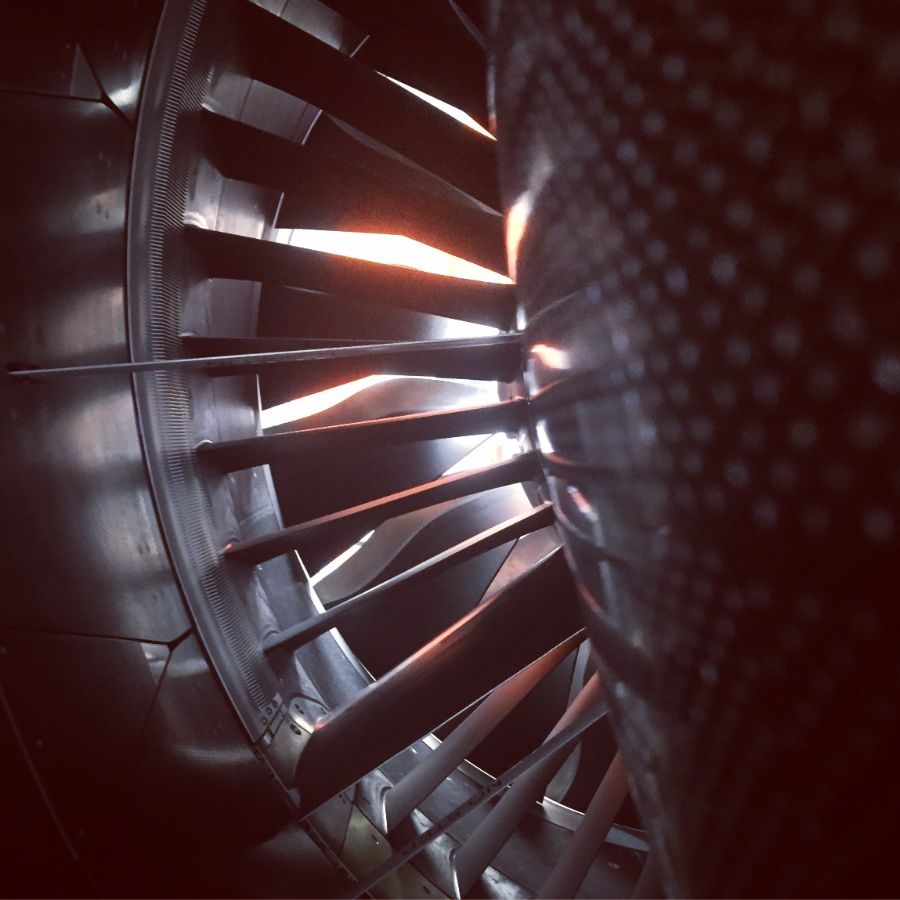

Starting or growing a restaurant or food service business can be a dream come true for many entrepreneurs. However, from location costs to kitchen equipment, the financial demands can be steep. That’s where the Meridian SBA team comes to the rescue.

Every culinary entrepreneur deserves a chance to shine. From fine dining to fast food, Meridian’s experienced Meridian SBA Team has the ingredients for your personal recipe for success. Get cooking. Contact our Meridian SBA Team today!