Security & Fraud Awareness Tips: Banks Never Ask That

- Scammers will create a false sense of urgency. A scammer can impersonate a Meridian Bank employee and pressure you to give up your credentials or send money. They could use threats like “act now or your account will be closed,” or they could seem helpful and friendly by saying “we’ve detected suspicious activity on your account.”

- Request for sensitive information. Never share sensitive information like your bank password, PIN, or a one-time login code with someone who calls you unexpectedly — even if they say they’re from Meridian Bank. A Meridian employee may need to verify your personal information if you call our bank, but never the other way around.

- The caller ID may be spoofed. Scammers can make any number or name appear on your caller ID. Even if it looks like Meridian Bank is calling, it could be anyone. Always be cautious of unexpected calls and stay safe by hanging up and dialing back Meridian Bank’s phone number: 866.327.9199.

For business banking customers, Meridian offers Positive Pay to prevent check or ACH fraud.

Upload a list of checks or ACH’s for matching to control unauthorized activity. If a payment presented doesn’t match what is on your list, you’ll decide if you want to pay or return it. If you’re interested in setting up Positive Pay for your business, fill out the form below to get started.

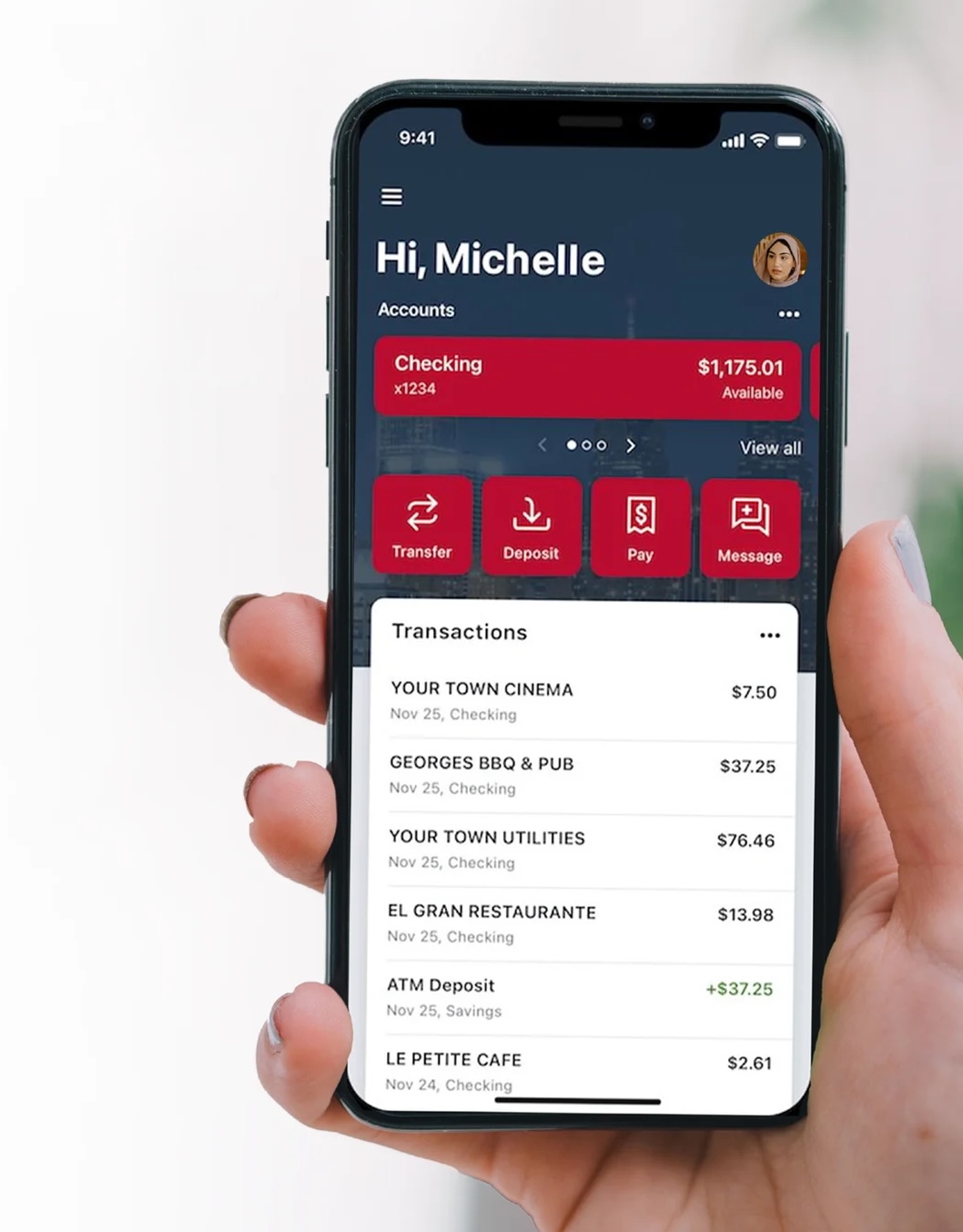

Not signed up for Digital Banking? Enroll today!

If you have a personal account, visit: meridianbanker.com/digital-banking

If you have a business account, please fill out the form below to get started.

Benefits Include:

- Electronic statements and notices

- Bill pay

- Account transfers

- Mobile deposit

- Card controls

- Account alerts

- Secure messaging