Scammers take advantage of the busy holiday season to trick individuals and businesses into giving away money or sensitive information. Common holiday scams include: fake delivery notifications, fraudulent charity requests, spoofed retailer messages, counterfeit gift card offers, and phishing emails disguised as holiday deals or travel confirmations.

Security & Fraud Awareness Tips: Seasonal Fraud Prevention

5 Ways to Stay Vigilant This Holiday Season

- Be cautious with unexpected emails or texts. During the holidays, scammers often impersonate trusted companies, shipping carriers, or even coworkers. Avoid clicking on links or opening attachments from unknown or unexpected senders. Always navigate directly to the company’s official website or app to confirm order or delivery details.

- Verify charity and gift requests. Fraudsters may pose as legitimate charities or even as friends or family members asking for help. Before donating or sending money, verify the organization through trusted sources, and confirm personal requests using separate, known contact information.

- Watch for fake offers and online shopping scams. If a deal looks too good to be true, it likely is. Stick to reputable retailers and avoid purchasing through unfamiliar links or social media ads.

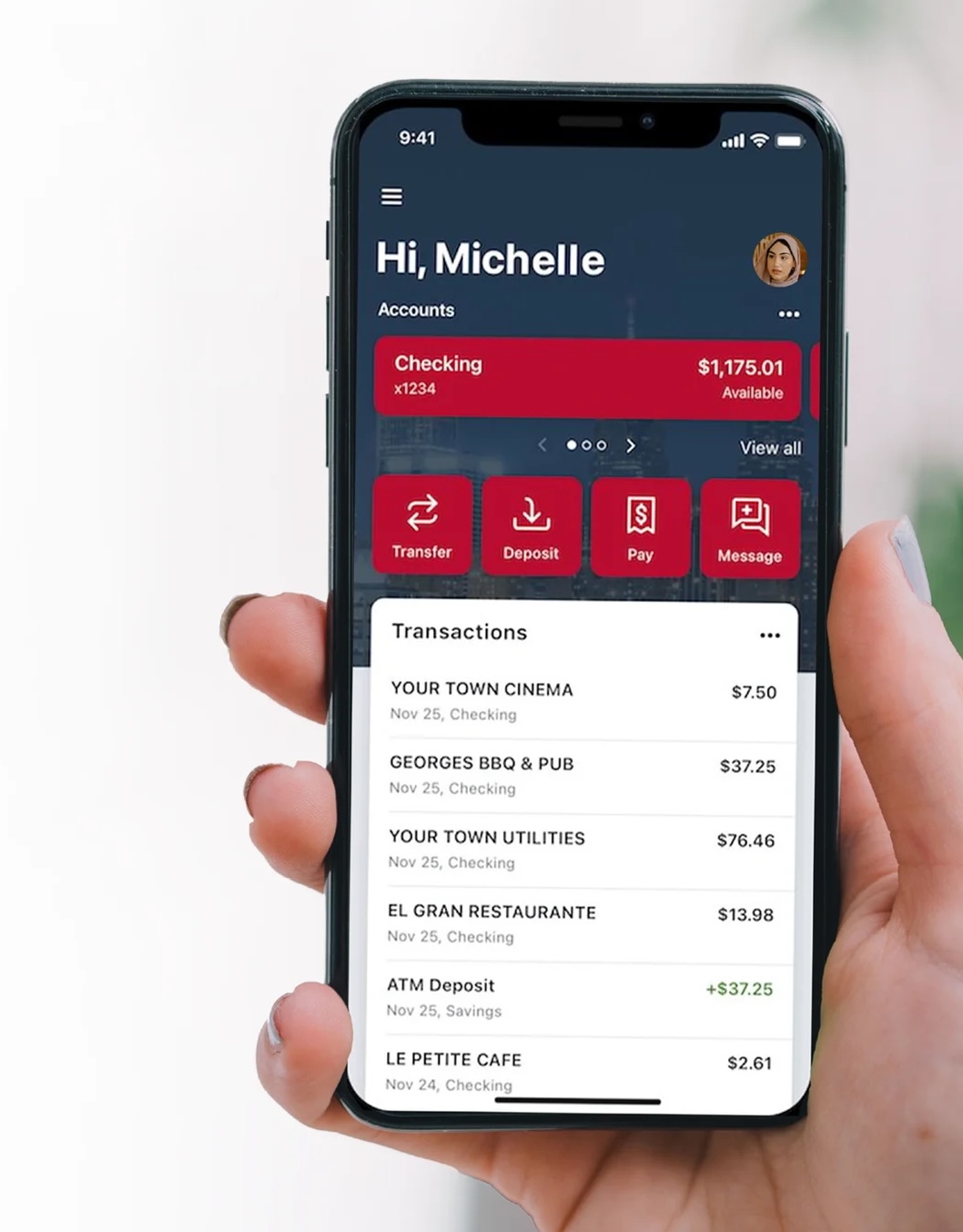

- Monitor your accounts and enable alerts. Review your bank and credit card activity frequently during the holiday season when fraudulent charges spike. Turn on account and card alerts in Meridian’s Digital Banking to receive real-time notifications of every transaction so you can quickly and easily identify fraudulent charges if they arise.

- Protect your devices when traveling. Scammers often target people on the go. Avoid connecting to public Wi-Fi when viewing financial information or making purchases. Keep your devices updated, use strong passwords, and enable two-factor authentication wherever possible.

For business banking customers, Meridian offers Positive Pay to prevent check or ACH fraud.

Upload a list of checks or ACH’s for matching to control unauthorized activity. If a payment presented doesn’t match what is on your list, you’ll decide if you want to pay or return it. If you’re interested in setting up Positive Pay for your business, fill out the form below to get started.

Not signed up for Digital Banking? Enroll today!

If you have a personal account, visit: meridianbanker.com/digital-banking

If you have a business account, please fill out the form below to get started.

Benefits Include:

- Electronic statements and notices

- Bill pay

- Account transfers

- Mobile deposit

- Card controls

- Account alerts

- Secure messaging