Identity theft is the unlawful use of another person’s identification or financial information without consent. Common methods include stealing your name, address, credit card or bank account numbers, Social Security number, or medical insurance information.

Security & Fraud Awareness Tips: Identity Theft

5 Ways to Protect Yourself from Identity Theft

-

- Avoid sending/receiving personal information in the mail. Meridian’s robust Digital Banking platform is a great solution for this. For example, enrolling in eStatements allows you to securely view account history and reduce the risk of sensitive information getting lost in the mail. Also, remote deposits and automatic transfers are a safer alternative to mailing checks.

- Obtain copies of your credit report annually to ensure they are accurate. Contact each of these three major reporting agencies for copies of your credit report. If you suspect your identity has been stolen, you can also request each of these agencies to place a fraud alert on your file:

- Secure your personal information. Shred sensitive records before disposing of them and store documents containing identifying data (e.g., Social Security card, passport, PIN numbers, passwords, credit/debit card information) in a safe place. Do not share this information in person, over the phone, or online before verifying the requestor using separate, known contact information.

- Add debit and/or credit card information to your virtual wallet. Using a virtual wallet like Apple or Google Pay eliminates the risks associated with carrying around more physical cards than necessary. It also offers a more secure method of payment with data encryption.

- Use strong, unique passwords. Create long passwords with a mix of letters, numbers, and symbols. Use different passwords for each account and consider two-factor authentication where applicable. For further security, you can also use a digital password vault like LastPass or 1Password.

For business banking customers, Meridian offers Positive Pay to prevent check or ACH fraud.

Upload a list of checks or ACH’s for matching to control unauthorized activity. If a payment presented doesn’t match what is on your list, you’ll decide if you want to pay or return it. If you’re interested in setting up Positive Pay for your business, fill out the form below to get started.

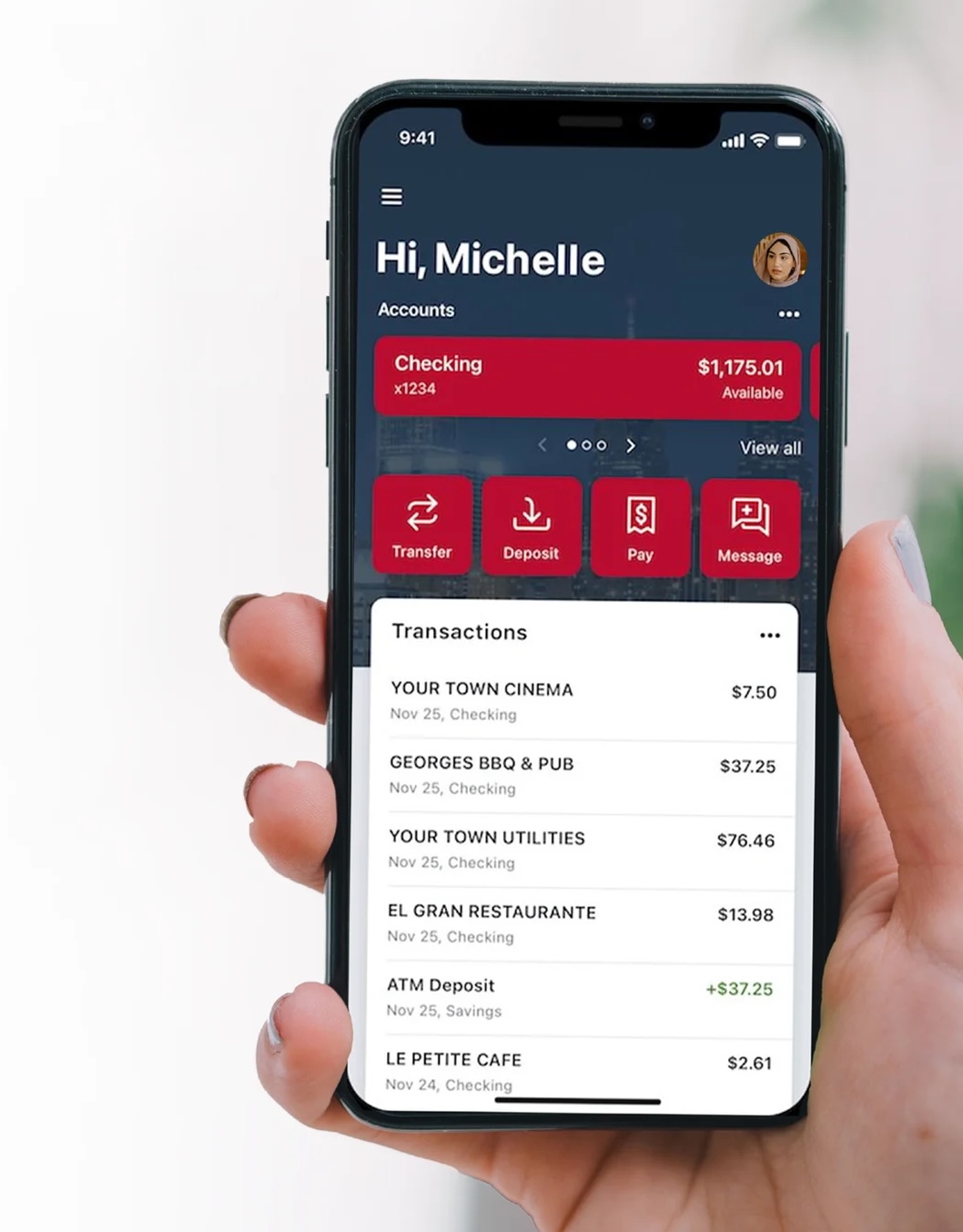

Not signed up for Digital Banking? Enroll today!

If you have a personal account, visit: meridianbanker.com/digital-banking

If you have a business account, please fill out the form below to get started.

Benefits Include:

- Electronic statements and notices

- Bill pay

- Account transfers

- Mobile deposit

- Card controls

- Account alerts

- Secure messaging